Hey there, home dreamers! If you're diving into the world of mortgages, you're in for a ride. Current mortgage rates are like the heartbeat of the housing market—they fluctuate, they influence, and they shape your financial decisions. Whether you're a first-time buyer or a seasoned homeowner, understanding these rates is key to securing the best deal for your dream property. So, buckle up and let’s break it down step by step!

Buying a home is one of the biggest investments you'll ever make. And when it comes to financing, mortgage rates play a starring role. They determine how much you'll pay each month and over the life of the loan. In this guide, we'll explore everything you need to know about current mortgage rates, from what affects them to how you can get the best rates possible.

But before we dive deep, let’s set the stage. Mortgage rates aren’t just numbers—they’re influenced by economic factors, market trends, and even your personal credit profile. By the end of this article, you'll be armed with the knowledge to navigate the mortgage maze like a pro. Let’s get started!

Read also:Remembering Jim Lehrer A Journalist Who Defined Integrity

What Are Current Mortgage Rates All About?

Alright, let's get down to brass tacks. Current mortgage rates refer to the interest rates lenders charge when you borrow money to buy a home. These rates can vary based on the type of loan, your credit score, and broader economic conditions. Think of them as the price tag for borrowing money.

Here’s the kicker: even a small change in mortgage rates can have a big impact on your monthly payments. For example, a 30-year fixed-rate mortgage at 4% versus 5% could mean thousands of dollars in savings over the life of the loan. That's why staying informed is crucial.

How Are Mortgage Rates Determined?

So, how do these rates come to life? It's a mix of macroeconomic factors and personal financial health. Let’s break it down:

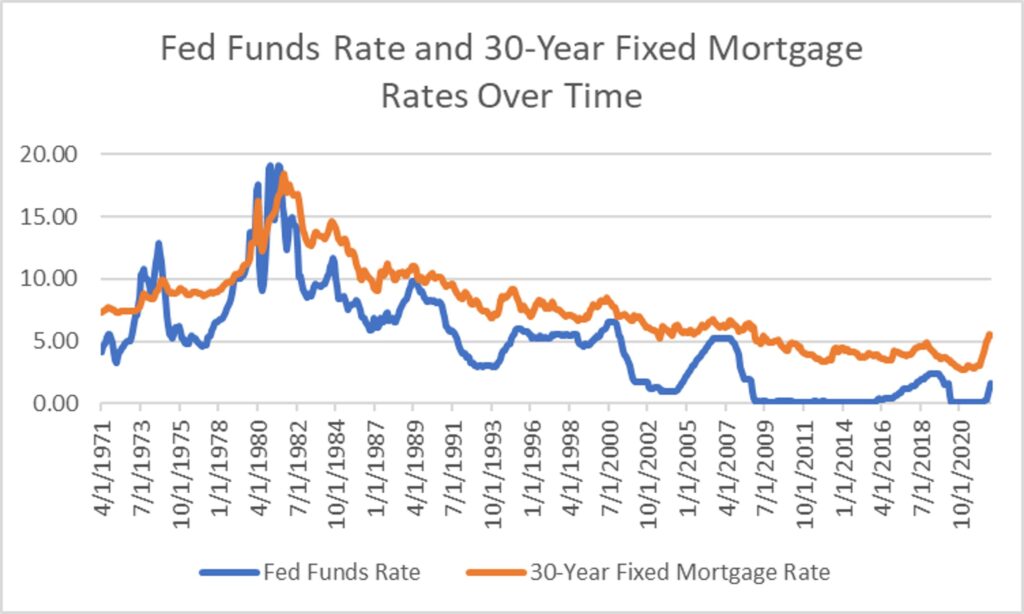

- Economic Indicators: The Federal Reserve, inflation, and unemployment rates all play a part in shaping mortgage rates. When the economy is strong, rates tend to rise, and vice versa.

- Your Credit Score: Lenders use your credit score to assess risk. A higher score can help you snag lower rates, while a lower score might mean higher rates or even loan denial.

- Loan Type: Fixed-rate mortgages offer stability, while adjustable-rate mortgages (ARMs) can start lower but fluctuate over time.

Understanding these factors can help you make smarter decisions about when to lock in a rate and what type of loan to choose.

Why Do Mortgage Rates Fluctuate?

Mortgage rates are like the weather—they’re unpredictable and constantly changing. But unlike the weather, there are some patterns and triggers that can help you anticipate shifts.

Factors That Influence Mortgage Rates

Here are the main culprits behind mortgage rate fluctuations:

Read also:Kelly Ripa And Ryan Seacrest Are Taking Their Friendship To New Heights With Work Wife

- Federal Reserve Actions: When the Fed adjusts interest rates, it ripples through the mortgage market. Lower rates can stimulate borrowing, while higher rates can slow it down.

- Inflation: Rising inflation often leads to higher mortgage rates as lenders try to keep up with the cost of living.

- Treasury Yields: Mortgage rates are closely tied to the yield on 10-year Treasury bonds. When bond yields rise, mortgage rates often follow suit.

By keeping an eye on these factors, you can time your mortgage application for the best possible rate.

Types of Mortgages: Fixed vs. Adjustable Rates

When it comes to current mortgage rates, not all loans are created equal. Let’s explore the two main types:

Fixed-Rate Mortgages

A fixed-rate mortgage offers stability. Your interest rate stays the same for the entire loan term, whether it’s 15, 20, or 30 years. This makes budgeting easier because your monthly payment remains consistent.

Adjustable-Rate Mortgages (ARMs)

ARMS, on the other hand, start with a lower introductory rate that adjusts periodically based on market conditions. While this can save you money in the short term, it comes with the risk of higher rates down the road.

Choosing between fixed and adjustable rates depends on your financial goals, risk tolerance, and how long you plan to stay in the home.

How to Get the Best Mortgage Rates

Now that you know the ins and outs of mortgage rates, let’s talk about how to score the best deal. Here are some tips:

- Boost Your Credit Score: A higher credit score can open doors to lower rates. Pay your bills on time, reduce debt, and monitor your credit report for errors.

- Shop Around: Don’t settle for the first lender you find. Compare offers from multiple lenders to ensure you’re getting the best rate.

- Consider Points: Discount points allow you to pay a fee upfront to lower your interest rate. This can be a smart move if you plan to stay in the home long-term.

Remember, the best mortgage rate for you isn’t always the lowest one. It’s the one that aligns with your financial situation and long-term goals.

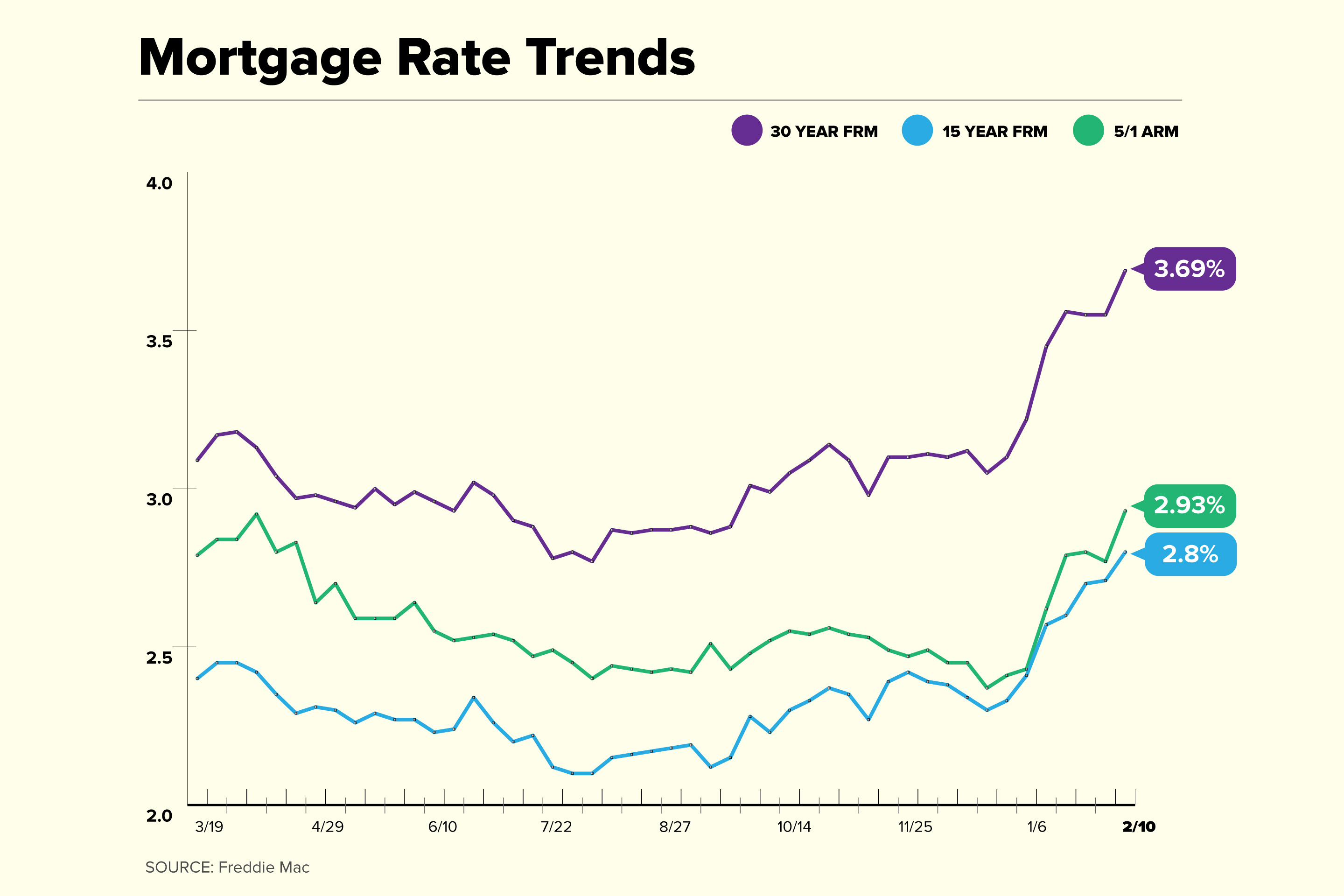

Current Mortgage Rates: A Snapshot

Let’s take a quick look at where mortgage rates stand right now. As of [insert date], the average 30-year fixed-rate mortgage is hovering around [insert current rate]. ARMs are currently at [insert rate], offering a tempting option for those who want to save upfront.

But don’t just take our word for it. Check out reputable sources like Freddie Mac, Bankrate, and NerdWallet for the latest rates and trends.

Tips for Locking in a Rate

Once you’ve found a rate you like, locking it in is crucial. Here’s how:

- Act Quickly: Mortgage rates can change daily, so if you see a rate you like, don’t hesitate.

- Understand the Lock-In Period: Most lenders offer rate lock periods ranging from 30 to 60 days. Make sure you can close within that timeframe.

- Read the Fine Print: Some locks come with fees, so be sure to understand the terms before committing.

Locking in a rate gives you peace of mind, knowing exactly what you’ll pay regardless of market fluctuations.

Understanding APR vs. Interest Rate

When shopping for a mortgage, you’ll encounter two key terms: APR and interest rate. Here’s the difference:

- Interest Rate: This is the cost of borrowing money, expressed as a percentage of the loan amount.

- APR (Annual Percentage Rate): This includes the interest rate plus other costs, like origination fees and points, giving you a more complete picture of the loan’s cost.

Always compare APRs when evaluating mortgage offers, as it provides a clearer view of the total cost.

Common Mistakes to Avoid

Even the savviest homebuyers can stumble when it comes to mortgage rates. Here are some common pitfalls to avoid:

- Not Shopping Around: Relying on one lender can cost you thousands in the long run. Always compare offers.

- Ignoring Fees: Hidden fees can add up quickly. Make sure you understand all the costs associated with your loan.

- Waiting Too Long: Rates can change overnight. If you find a good rate, lock it in sooner rather than later.

By steering clear of these mistakes, you can ensure you’re getting the best deal possible.

The Future of Mortgage Rates

Looking ahead, the mortgage rate landscape is likely to shift as economic conditions evolve. Experts predict that rates may rise slightly in the coming months due to inflation and Fed policies. However, they’re still historically low compared to previous decades.

Preparing for Rate Changes

Whether rates go up or down, being prepared is key. Here’s how:

- Stay Informed: Follow economic news and trends to anticipate rate movements.

- Build Equity: If you already own a home, building equity can help you refinance at better rates in the future.

- Explore Options: Consider different loan types and terms to find the best fit for your situation.

The more prepared you are, the better equipped you’ll be to handle any changes in the market.

Conclusion: Your Path to Homeownership

Alright, folks, we’ve covered a lot of ground. Current mortgage rates are a critical piece of the homeownership puzzle, and understanding them can save you serious cash.

Remember, the key to securing the best rate is preparation, research, and timing. Boost your credit, shop around, and lock in a rate when the time is right. And don’t forget to consider all the factors that influence rates, from economic indicators to personal finances.

Now it’s your turn. Leave a comment below sharing your thoughts or questions about mortgage rates. Or, if you found this guide helpful, share it with a friend who’s also navigating the mortgage maze. Together, let’s make smart financial decisions and turn those home dreams into reality!

Happy house hunting, and may your mortgage journey be smooth and stress-free!

Table of Contents

- What Are Current Mortgage Rates All About?

- How Are Mortgage Rates Determined?

- Why Do Mortgage Rates Fluctuate?

- Types of Mortgages: Fixed vs. Adjustable Rates

- How to Get the Best Mortgage Rates

- Current Mortgage Rates: A Snapshot

- Understanding APR vs. Interest Rate

- Common Mistakes to Avoid

- The Future of Mortgage Rates

- Conclusion: Your Path to Homeownership