Hey there, tax season warrior! If you're reading this, chances are you're already bracing yourself for the annual battle with Uncle Sam. But don’t worry—this isn’t just about filing forms or paying what you owe. It’s also about getting your hands on those sweet IRS tax refunds 2025 dollars! Whether it’s saving for that dream vacation, paying off debt, or simply padding your emergency fund, understanding how to claim your refund is crucial. Let’s dive in!

Let’s face it, nobody loves doing taxes. But hey, if there’s one thing that can make it slightly less painful, it’s knowing you might be getting a chunk of cash back from the IRS. That’s right—we’re talking about IRS tax refunds in 2025. This year could bring some big changes, new rules, and even better opportunities for you to get more money back. So buckle up because we’re about to break it all down for ya.

In this guide, we’ll cover everything from the basics of IRS tax refunds to advanced strategies that could help you maximize your return. We’ll also touch on deadlines, common mistakes to avoid, and how to stay ahead of the game. So whether you’re a seasoned pro or a first-timer, there’s something here for everyone. Now, let’s get into the nitty-gritty!

Read also:Aerosmith Rocks The 2020 Grammys Drama Legends And A Legendary Performance

Understanding IRS Tax Refunds 2025: What You Need to Know

Before we jump into the deep end, let’s clear up what exactly IRS tax refunds are. Simply put, when you pay more taxes than you owe during the year, the IRS gives you the extra back. Sounds simple enough, right? But here’s the thing—it’s not always as straightforward as it seems. Factors like your income, deductions, credits, and even life events can impact how much you get back. And with the 2025 tax season just around the corner, it’s time to get informed.

Key Changes for 2025 Tax Refunds

Every year, the IRS tweaks its rules, and 2025 is no exception. Here are a few key changes you should be aware of:

- Standard Deduction Increase: The standard deduction is going up, which means more people might qualify for bigger refunds.

- New Child Tax Credit Rules: If you’ve got kids, listen up! There might be new guidelines affecting how much credit you can claim.

- Energy Credits Expansion: If you’ve made eco-friendly upgrades to your home, you could be eligible for expanded energy credits.

These updates could mean bigger refunds for many taxpayers, so it’s worth staying on top of them.

How to Maximize Your IRS Tax Refunds 2025

Now that you know the basics, let’s talk strategy. Maximizing your refund isn’t just about filling out forms correctly—it’s about leveraging every possible deduction and credit available to you. Here’s how you can do it:

Claim Every Deduction You’re Eligible For

Deductions reduce your taxable income, which can lead to a bigger refund. Some popular deductions include:

- Mortgage interest

- Student loan interest

- Medical expenses

- Charitable contributions

Don’t forget to itemize if it benefits you more than the standard deduction!

Read also:Transform Your Smile The Ultimate Teeth Whitening Solution

Take Advantage of Tax Credits

Credits directly reduce the amount of tax you owe, so they’re usually more valuable than deductions. Here are a few credits to consider:

- Child Tax Credit

- Earned Income Tax Credit (EITC)

- Education credits like the American Opportunity Credit

Make sure you’re claiming every credit you qualify for—it could add up to serious cash.

Common Mistakes to Avoid When Filing for IRS Tax Refunds 2025

Even the best-laid plans can go awry if you make common filing mistakes. Here are a few pitfalls to watch out for:

Incorrect Social Security Numbers

One small typo in your SSN can delay or even stop your refund. Double-check every number before submitting your return.

Missing Forms

Make sure you’ve included all necessary forms and documents. Missing W-2s or 1099s can cause major headaches down the line.

Incorrect Bank Account Information

If you’re opting for direct deposit, ensure your bank account details are correct. Otherwise, your refund might end up in limbo.

Avoiding these mistakes can save you a lot of time and frustration. Trust me, nobody wants to wait weeks—or even months—for their refund because of a silly error.

Deadlines You Can’t Afford to Miss

Knowing the deadlines is half the battle. For IRS tax refunds 2025, here’s what you need to keep in mind:

April 15th Filing Deadline

Mark your calendars—April 15th is the big day. If you miss this deadline, you risk penalties and interest on any taxes you owe. Plus, your refund could be delayed.

Extension Requests

If you can’t file by April 15th, you can request an extension. But remember, this only extends the filing deadline—not the payment deadline. You still need to pay any taxes owed by April 15th to avoid penalties.

Stay organized and plan ahead to ensure you meet all deadlines without stress.

Where Will Your Refund Go?

Once you’ve got your IRS tax refunds 2025 money in hand, what’s the plan? Here are a few ideas:

Pay Off Debt

Using your refund to tackle high-interest debt is a smart move. Every dollar you put toward debt is a dollar you won’t have to pay interest on later.

Save for the Future

Whether it’s an emergency fund, retirement account, or college savings, investing in your future is always a good idea.

Treat Yo’ Self

Of course, there’s nothing wrong with treating yourself to something special. Just make sure it’s within reason and doesn’t derail your financial goals.

Deciding where your refund goes depends on your priorities. Whatever you choose, make sure it’s a decision you’ll feel good about later.

How Long Does It Take to Get Your IRS Tax Refunds 2025?

Patiently waiting for your refund can feel like watching paint dry. But how long does it really take? Here’s the lowdown:

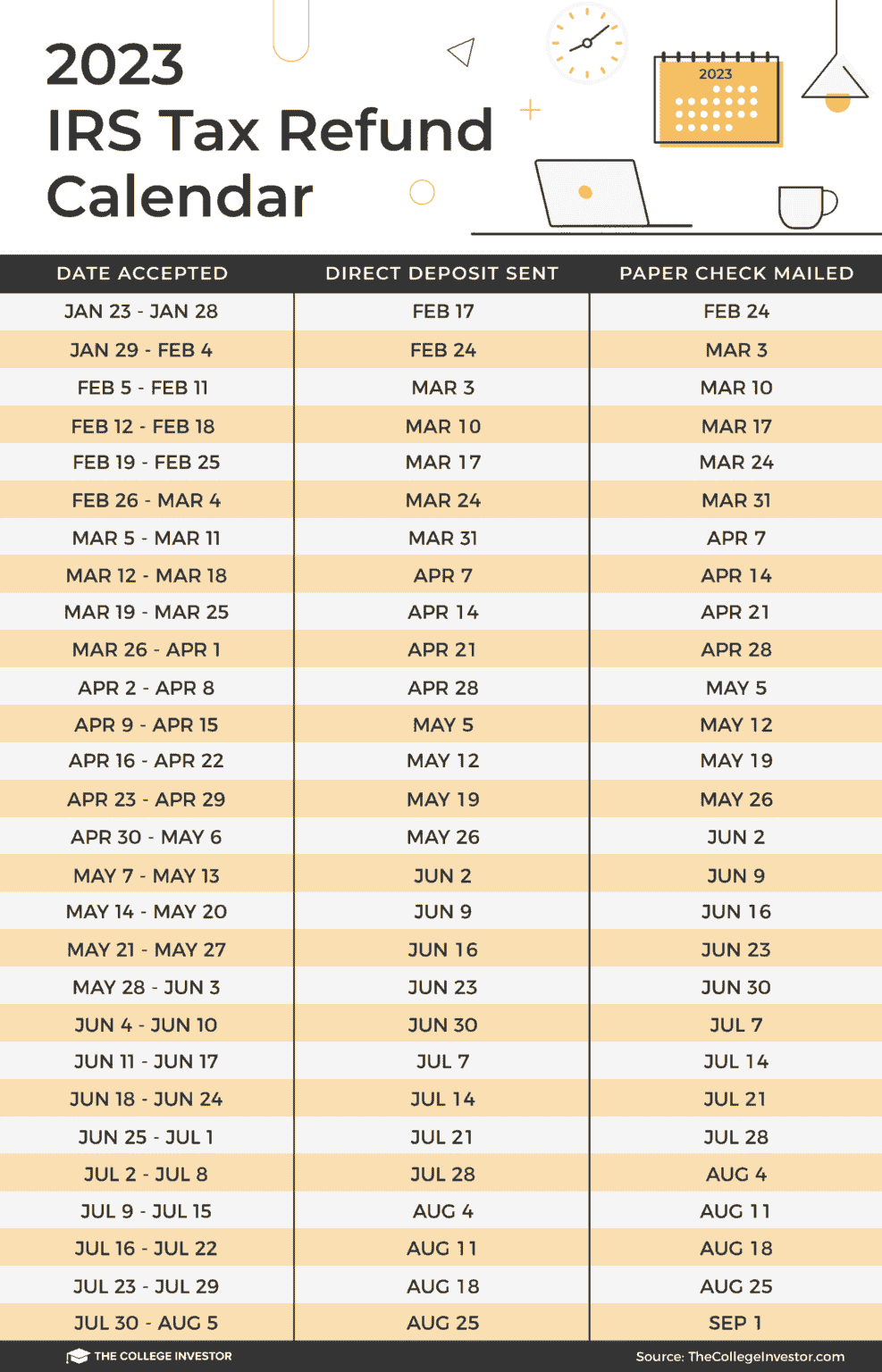

Direct Deposit vs. Check

If you opt for direct deposit, you can usually expect your refund within 21 days. Paper checks, on the other hand, can take significantly longer—sometimes up to six weeks.

Factors That Can Delay Your Refund

Some factors, like errors in your return or audits, can delay your refund. Make sure everything is accurate and complete to avoid unnecessary delays.

Keep an eye on the IRS’s “Where’s My Refund?” tool for real-time updates on the status of your return.

IRS Tax Refunds 2025: Who Qualifies?

Not everyone gets a refund, but most taxpayers do if they’ve overpaid their taxes throughout the year. Here’s who typically qualifies:

Employees Withheld Too Much Tax

If your employer withheld more taxes from your paycheck than you owed, you’re due a refund.

Self-Employed Individuals

Even if you’re self-employed, you can still qualify for a refund if you overpaid through estimated quarterly taxes.

Retirees and Non-Wage Earners

Even if you don’t earn traditional wages, you might still qualify for certain credits or refunds based on your income and expenses.

Remember, the only way to know for sure is to file your return!

Tools and Resources to Help You File for IRS Tax Refunds 2025

Filing your taxes doesn’t have to be a nightmare. Here are a few tools and resources to make the process smoother:

Tax Preparation Software

Programs like TurboTax or H&R Block can walk you through the filing process step by step, ensuring you don’t miss anything important.

IRS Free File

If your income qualifies, you can use the IRS Free File program to file your taxes online for free.

Tax Professionals

Sometimes, it pays to hire a professional. A good accountant or tax preparer can help you maximize your refund and avoid costly mistakes.

Choose the option that works best for your situation and comfort level.

Final Thoughts: Time to Cash In on IRS Tax Refunds 2025

And there you have it—your ultimate guide to IRS tax refunds 2025. Whether you’re a seasoned pro or a first-time filer, understanding the ins and outs of tax refunds can make a huge difference in your financial health. By staying informed, avoiding common mistakes, and leveraging every credit and deduction available to you, you can maximize your return and put that money to good use.

So what are you waiting for? Start gathering your documents, crunching the numbers, and getting ready to file. And when that refund hits your account, don’t forget to share the love—leave a comment, share this article, or check out our other tax-related content. Happy filing, and may your refund be generous!

Table of Contents

- Get Ready for IRS Tax Refunds 2025

- Understanding IRS Tax Refunds 2025

- Key Changes for 2025 Tax Refunds

- How to Maximize Your IRS Tax Refunds 2025

- Claim Every Deduction You’re Eligible For

- Take Advantage of Tax Credits

- Common Mistakes to Avoid

- Deadlines You Can’t Afford to Miss

- Where Will Your Refund Go?

- How Long Does It Take to Get Your IRS Tax Refunds 2025?